- Consistent Revenue Growth: Steady increases in sales over time indicate strong demand and market traction.

- Healthy Profit Margins: Strong gross and net margins show your business converts revenue into sustainable profit efficiently.

- Positive Cash Flow: Being able to cover operating costs, pay employees, and invest in growth is a clear sign of financial health.

- Controlled Operating Expenses: Keeping costs in check allows for reinvestment and protects profitability.

- Customer Acquisition vs. Lifetime Value: Spending less to acquire customers than you earn from them ensures sustainable growth.

- Balanced Debt and Investments: A manageable debt-to-equity ratio and high ROI indicate sound financial decisions and resource efficiency.

- Effective Accounts Receivable/Payable Management: Monitoring AR and AP ensures operational discipline and avoids cash flow problems.

Running a business is an exciting journey, but how do you know if your business is truly succeeding? While customer satisfaction, employee engagement, and market presence matter, financial health often provides the clearest window into business success. By tracking the right financial indicators, you can gain actionable insights into your company’s performance and long-term sustainability.

In this article, we’ll explore the most important financial signs of a successful business and what each one can tell you. Whether you’re a new entrepreneur or a seasoned business owner, understanding these metrics will help you make smarter decisions and keep your business on a growth path.

Why Financial Indicators Matter

Financial indicators are more than just numbers on a spreadsheet. They reflect the health of your business and provide clues about its future. In fact, these metrics are some of the most important business success factors, as they reveal trends, highlight potential problems, and indicate opportunities for growth.

Some of the key reasons financial indicators matter include:

- Decision-Making: They guide strategic decisions about investments, expansions, and cost management.

- Investor Confidence: Strong financials attract investors and lenders who want to support businesses with growth potential.

- Sustainability: Healthy financial indicators show that a business can survive market changes and economic challenges.

By paying attention to financial indicators, you can identify early warning signs of trouble and celebrate areas of success.

What Are the Key Financial Indicators of a Successful Business?

Several financial metrics give you a clear picture of your business’s performance. Let’s break down the most essential ones.

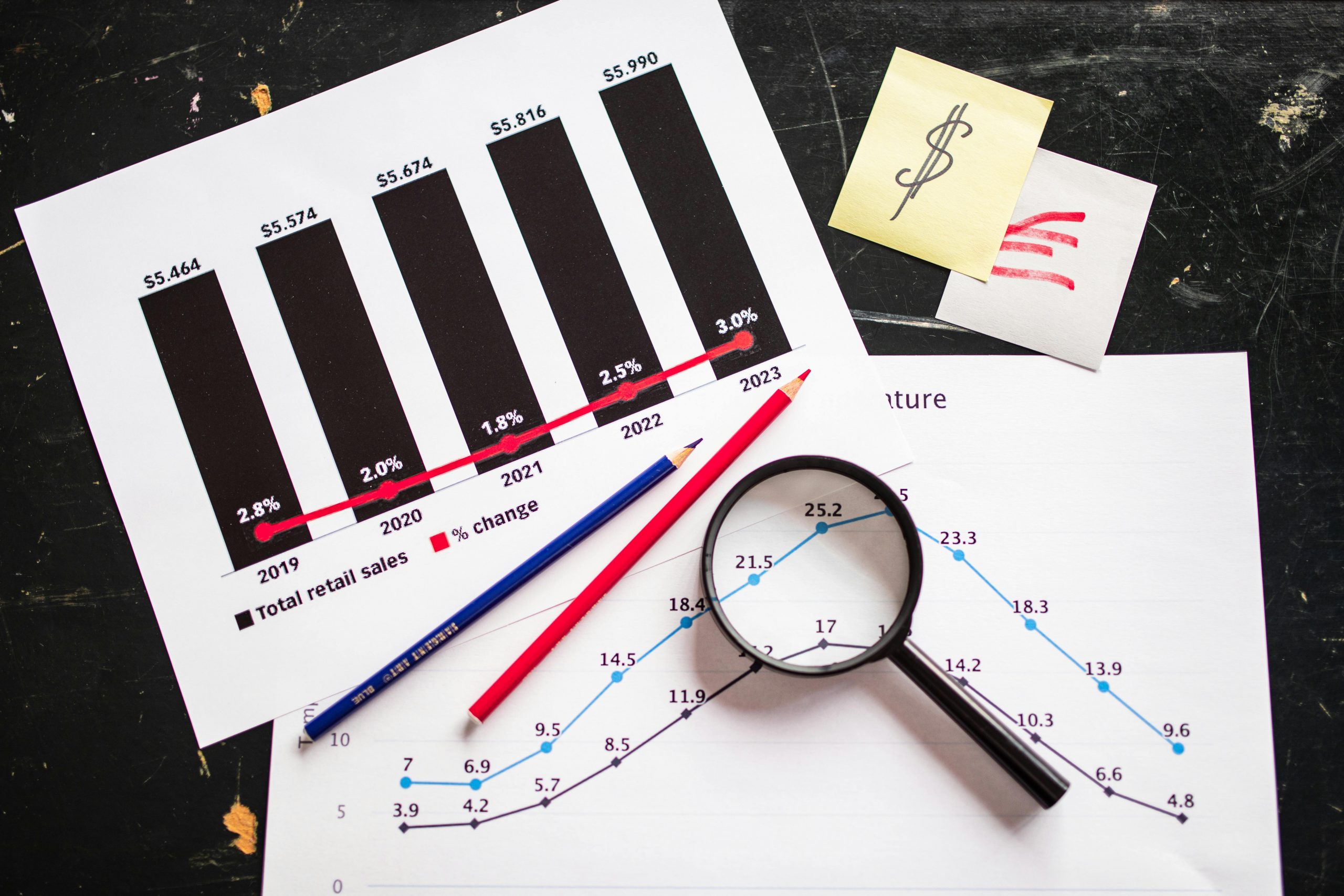

1. Revenue Growth: Are You Consistently Increasing Sales?

Revenue is the lifeblood of any business. Tracking revenue growth over time shows whether your products or services are gaining traction in the market.

- Compare monthly, quarterly, and yearly revenue trends.

- Look for consistent growth, even if it’s gradual.

- Sudden spikes or drops may indicate seasonal trends or operational issues.

A business that consistently grows its revenue demonstrates demand for its offerings, which is a clear sign of success.

2. Profit Margins: Are You Earning Enough From Sales?

Revenue alone doesn’t tell the full story. Profit margins—both gross and net—show how efficiently a business converts sales into profit.

- Gross Margin: Measures profitability after direct costs of producing goods or services.

- Net Margin: Shows how much profit remains after all expenses, including overhead, taxes, and interest.

Healthy profit margins indicate that your pricing strategy, cost management, and operational efficiency are on point. Low margins, even with high revenue, could signal inefficiencies or unsustainable expenses.

3. Cash Flow: Can You Pay Your Bills and Invest in Growth?

Even profitable businesses can fail if they don’t manage cash flow properly. Positive cash flow ensures you can cover operating costs, pay employees, and invest in new opportunities.

- Monitor cash inflows and outflows regularly.

- Ensure that receivables are collected promptly and payables are managed wisely.

- Maintain a cash reserve to handle unexpected expenses.

A strong cash flow is one of the clearest signs of a financially healthy business.

4. Operating Expenses: Are Costs in Check?

Keeping operating expenses under control is crucial for profitability. High expenses can eat into your profits and slow down growth.

- Track fixed costs (rent, salaries) and variable costs (materials, utilities).

- Look for opportunities to reduce waste without compromising quality.

- Compare expenses as a percentage of revenue to industry benchmarks.

Businesses that manage expenses effectively can reinvest profits into growth and innovation.

5. Customer Acquisition Cost (CAC) vs. Customer Lifetime Value (CLV)

Understanding the relationship between CAC and CLV is essential for long-term profitability.

- CAC: How much it costs to acquire a new customer.

- CLV: The total revenue expected from a customer over their relationship with your business.

A successful business spends less to acquire customers than it earns from them. Monitoring this ratio helps ensure sustainable growth and marketing efficiency.

6. Debt-to-Equity Ratio: How Leverage Affects Your Business

Debt can be a useful tool for growth, but too much debt can strain finances. The debt-to-equity ratio measures the balance between borrowed funds and the owner’s equity.

- A lower ratio generally indicates a more stable business.

- A higher ratio may suggest aggressive expansion but increases financial risk.

- Compare your ratio to industry averages to gauge healthy leverage.

Businesses that maintain a manageable debt-to-equity ratio demonstrate financial stability and sound management.

7. Accounts Receivable and Payable Management

Efficient management of accounts receivable (AR) and accounts payable (AP) keeps your cash flow healthy.

- AR: Track how quickly customers pay their invoices. Slow collections can cause cash shortages.

- AP: Manage payments to suppliers to maintain good relationships without overextending cash.

A business that balances AR and AP effectively shows operational discipline, another sign of success.

8. Return on Investment (ROI): Are Your Investments Paying Off?

ROI measures the profitability of investments in equipment, marketing, or other business initiatives.

- Calculate ROI for major projects to see if they generate expected returns.

- Prioritize investments with high ROI to maximize growth.

- Review ROI regularly to make informed strategic decisions.

High ROI indicates that resources are being used efficiently, a hallmark of a successful business.

How to Track Financial Indicators Effectively

Monitoring financial indicators consistently is key. Here are some best practices:

- Use Accounting Software: Tools like QuickBooks, Xero, or FreshBooks simplify tracking.

- Regular Reporting: Prepare monthly, quarterly, and annual financial reports.

- Benchmarking: Compare metrics against industry standards.

- Hire a Financial Advisor: Experts can interpret data and provide strategic guidance.

- Dashboards: Visual dashboards help you spot trends at a glance.

Tracking these indicators provides real-time insights and helps avoid financial pitfalls.

Common Mistakes to Avoid

Even businesses that are profitable can struggle if financial indicators aren’t properly managed. Avoid these common mistakes:

- Focusing only on revenue without considering profit margins or cash flow.

- Ignoring debt levels and over-leveraging.

- Neglecting regular financial reviews and relying solely on intuition.

- Spending too much on customer acquisition without calculating CLV.

- Failing to maintain cash reserves for emergencies.

Being proactive with your financial analysis prevents these issues from escalating.

Beyond Numbers: Combining Financial Indicators With Other Success Metrics

While financial indicators are crucial, a comprehensive view of business success includes other areas:

- Customer Satisfaction: Happy customers lead to repeat business and referrals.

- Employee Engagement: Motivated teams drive productivity and innovation.

- Market Position: A growing market share signals competitiveness and relevance.

Combining financial metrics with operational and strategic indicators gives a fuller picture of business success.

When to Seek Professional Help

Some financial indicators may be complex or require advanced analysis. Consider consulting a professional if:

- You struggle to interpret financial ratios.

- Cash flow problems persist despite strong revenue.

- You’re planning major expansions or investments.

- Tax or compliance issues arise.

A financial advisor or accountant can help translate numbers into actionable strategies.

In Closing

Financial indicators provide a clear lens through which to evaluate the health of your business. Monitoring metrics like revenue growth, profit margins, cash flow, and ROI helps you make informed decisions and avoid surprises. While numbers don’t tell the whole story, they are a reliable foundation for assessing success.

A business that tracks and responds to these indicators demonstrates not just short-term profitability but also long-term sustainability. Start monitoring your financial signs today, and you’ll be better equipped to steer your business toward growth and lasting success.